Toutes ces recettes astucieuses sont préparés avec des ingrédients allégés en sucre et matières grasses.

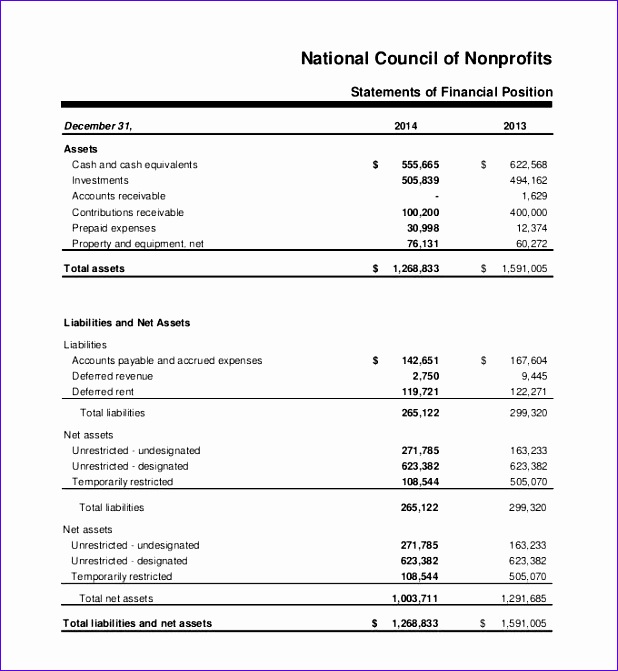

Nonprofit Statement of Financial Position or Balance Sheet

High net assets signal a strong financial position, while low net assets may indicate financial instability or debt concerns. The statement of functional expenses gives donors more details on how the organization spends funds. Liabilities include things like salaries, debt, and grants to other organizations.

Taxes for nonprofits

This includes cash received from customers, cash paid to suppliers and employees, and other operating cash flows. It is an important indicator of the organization’s ability 2020 tax changes for 1099 independent contractors to generate cash from its core operations. Reach out to a professional nonprofit accountant for help creating and interpreting your nonprofit’s balance sheet.

What Is the Most Difficult Part of Preparing the Statement?

- Statement of Functional Expenses is a crucial financial document that provides detailed information on how a non-profit organization allocates its expenses.

- By categorizing expenses based on their functions, such as programs, administration, and fundraising, the statement helps stakeholders understand how resources are being utilized.

- These financial statements are crucial for stakeholders to assess the financial performance and stability of a nonprofit organization.

- Consider using a zero-based budgeting system to track and identify potential areas to cut spending.

It includes the debts and obligations that the organization owes to external parties. By understanding the Liabilities Section, stakeholders can assess the organization’s ability to meet its financial obligations. Additionally, the section of additional disclosures may include information about related party transactions, contingent liabilities, and other relevant matters.

But first, a quick note on nonprofit financial statements vs. internal financial reports…

Like the income statement, it tells you how “profitable” your NFP was over a given period by showing your revenue, minus your expenses and losses. It gives you a snapshot of a nonprofit’s financial health at a point in time by displaying what the organization owns (assets), what it owes to others (liabilities), and its value (net assets). In this section, you can find information about the cash generated from the sale of goods or services, as well as any cash payments made for operating expenses such as salaries, rent, and utilities.

Key Elements in a Nonprofit Balance Sheet

It typically details all revenue, such as contributions, grants, salaries, administrative costs, and program costs. The point of this statement is to help determine whether or not the organization meets its goals or has enough funds to support its programs. You’ll be able to provide a snapshot of the organization’s financial health so that stakeholders can assess its performance and decide its future direction. Most importantly, you should adhere to proper disclosure procedures in all financial statements as outlined in GAAP guidelines.

Donors often look at these statements to evaluate the organization’s financial stability and effectiveness in achieving its mission. Overall, nonprofit financial statements play a critical role in promoting transparency, accountability, compliance, and informed decision-making within nonprofit organizations. In this article, we have explored the sample financial statements for nonprofit organizations. We discussed the importance of financial transparency and accountability in the nonprofit sector. By providing a clear and comprehensive overview of the financial health of an organization, these statements help donors, stakeholders, and the general public make informed decisions. We examined the key components of nonprofit financial statements, including the statement of financial position, statement of activities, and statement of cash flows.

It includes assets, liabilities, and equity, which can help stakeholders assess the financial health and stability of a business. If your organization uses an accrual method accounting practice, nonprofit balance sheets are more accurate. Funds are related to the day of the event instead of when funds actually arrive. Nonprofit accounting associations offer resources, training, and support specifically tailored to the needs of nonprofit organizations. These associations can provide information on best practices, accounting standards, and regulatory compliance for nonprofits. Strong nonprofit accounting practices are the foundation for efficient financial management.

The Notes to the Financial Statements provide additional information and explanations to the financial statements. They include details about accounting policies, significant transactions, contingencies, and other relevant information that helps users understand the financial statements. The Changes in Net Assets section of the Statement of Activities provides valuable information about the financial health and sustainability of a nonprofit organization.