Toutes ces recettes astucieuses sont préparés avec des ingrédients allégés en sucre et matières grasses.

How to Calculate When Your Solar Panels Will Start Saving You Money

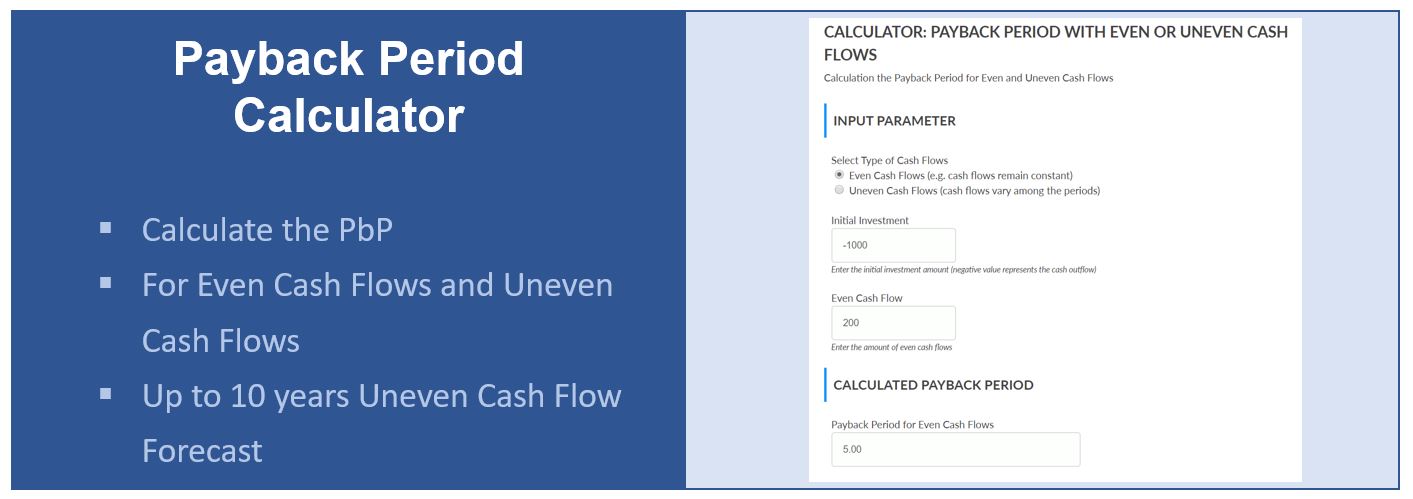

It is an important calculation used in capital budgeting to help evaluate capital investments. For example, if a payback period is stated as 2.5 years, it means it will take 2½ years to receive your entire initial investment back. In its simplest form, the formula to calculate the payback period involves dividing the cost of the initial investment by the annual cash flow. The decision rule is a simple rule to determine if an investment is worthwhile, and which of several investments is most worthwhile.

Fixed Cash Flow

- Thus, at $250 a week, the buffer will have generated enough income (cash savings) to pay for itself in 40 weeks.

- The shortest payback period is generally considered to be the most acceptable.

- No such adjustment for this is made in the payback period calculation, instead it assumes this is a one-time cost.

- The second project will take less time to pay back, and the company’s earnings potential is greater.

Discounted payback period will usually be greater than regular payback period. Investments with higher cash flows toward the end of their lives will have greater discounting. The payback period is a simple measure of how long it takes for a company to recover its initial investment in a project from the project’s expected future cash inflows. As such, it should not be used alone payback period formula as an investment appraisal technique – other methods should be used such as ROI, NPV or IRR. In its simplest form, the payback period is calculated by dividing the initial investment by the annual cash inflow. Forecasted future cash flows are discounted backward in time to determine a present value estimate, which is evaluated to conclude whether an investment is worthwhile.

How to Change Chart Type in Excel

When he does, the $720,000 he receives will not be equal to the original $720,000 he invested. This is because inflation over those 6 years will have decreased the value of the dollar. This means that it will actually take Jimmy longer than 6 years to get back his original investment. The Payback Period Calculator can calculate payback periods, discounted payback periods, average returns, and schedules of investments.

Use Excel to Make Informed Investment Decisions

In this article, we will explain the difference between the regular payback period and the discounted payback period. You will also learn the payback period formula and analyze a step-by-step example of calculations. Here, if the payback period is longer, then the project does not have so much benefit. However, a shorter period will be more acceptable since the cost of the investment can be recovered within a short time. It is considered to be more economically efficient and its sustainability is considered to be more. Since some business projects don’t last an entire year and others are ongoing, you can supplement this equation for any income period.

Company C is planning to undertake a project requiring initial investment of $105 million. The project is expected to generate $25 million per year in net cash flows for 7 years. Now it’s time to enter the data you have gathered into the Excel spreadsheet. In the cash inflow column, enter the expected cash inflow for each year. This sum tells you how much cash you’ve generated up until that point in time. When cash flows are NOT uniform over the use full life of the asset, then the cumulative cash flow from operations must be calculated for each year.

The payback period is a metric in the field of finance that helps in assessing the time requirement for recovering the initial investment made in a project. It has a wide usage in the investment field to evaluate the viability of putting money in an opportunity after assessing the payback time horizon. Using the averaging method, the initial amount of the investment is divided by annualized cash flows an investment is projected to generate.

For example, the payback period on a home improvement project can be decades while the payback period on a construction project may be five years or less. When you decide to go solar, you are either committing to a significant upfront cost of tens of thousands of dollars or a long-term plan through several years of monthly payments. The breakeven point, or payback period, is the time it takes to recoup the cost from the initial investment. Let’s say Jimmy does buy the machine for $720,000 with net cash flow expected at $120,000 per year. The payback period calculation tells us it will take him 6 years to get his money back.

A payback period of around 10 years is pretty average, and could end up being a solid investment, Haenggi said. You probably never thought much about your roof, but it makes a big difference in how your solar investment will play out. If your roof has room for lots of panels that soak in the sun all day, you’ll produce a ton of electricity and see a quicker payback. If you live on a shady lot, and your panels’ production is more intermittent, you won’t see a payback quite as quickly. You might, like many Americans, want to help the environment by avoiding fossil fuels. Perhaps you want to protect your home from blackouts, a common problem during summer months.

The first column (Cash Flows) tracks the cash flows of each year – for instance, Year 0 reflects the $10mm outlay whereas the others account for the $4mm inflow of cash flows. The inflation rate for consumer prices in the United States, according to the Bureau of Labor Statistics in June 2024. Investors should consider the diminishing value of money when planning future investments.

The payback period is a fundamental capital budgeting tool in corporate finance, and perhaps the simplest method for evaluating the feasibility of undertaking a potential investment or project. The Payback Period measures the amount of time required to recoup the cost of an initial investment via the cash flows generated by the investment. The payback period is favored when a company is under liquidity constraints because it can show how long it should take to recover the money laid out for the project. If short-term cash flows are a concern, a short payback period may be more attractive than a longer-term investment that has a higher NPV.